A hurricane and storm damage claims adjuster is a representative who inspects property damage and recommends an amount to be paid for repairs.

A claims adjuster is not your advocate but rather an agent of the insurance company. Claims adjusters are equipped with special skills to assess damages and make recommendations based on their findings.

You should hire an independent claims adjuster if you don’t have enough experience dealing with insurance companies or want someone who can protect your interests throughout the process.

If you’re unsure where to find a high-quality claims adjuster for storm damage, look no further than Link Public Adjusting Group.

The Process

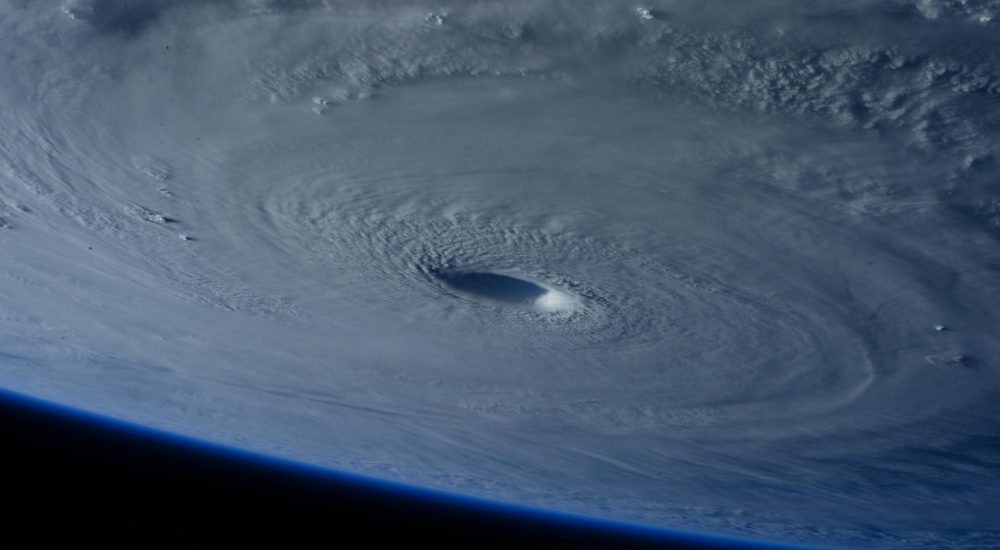

In the event of a Florida hurricane or tropical storm, a property insurance policy typically covers damage to the structure of a building. If there is apparent direct physical damage, such as entire roofs or walls being blown away, then determining coverage becomes easy. The property owner’s primary concern becomes, “What is the full value of repair or replacement to make me whole again?”

The process of answering that question can be complicated.

Get The Payout You Deserve

Insurance claim adjustments for storm, fire, water, and other disasters.

Location Inspection

A storm damage claims adjuster will inspect the location and evaluate the damage. The storm damage claims adjuster is a representative of your insurance carrier – not yours. It’s important to remember that the best way to protect yourself against unfair settlement offers is to hire an independent claims adjuster.

It’s All in the Details

The adjuster will also look at details like the age of the structure, materials used in its construction and repair, and specific types of damage. If your roof or foundation is older than ten years old, it may not be covered by your insurance policy.

The adjuster will also determine if any repairs have been made to structures that have been damaged during a storm event. For example: If you had a tree fall on your home during high winds and then repaired it before calling your insurance company for assistance, you may be denied coverage because the incident was not reported within 48 hours after it occurred (or as soon as practical).

Prepare Reports and Determine the Value

The adjuster will be looking at the situation from the insurance company’s perspective, which means they will be looking at the facts of the case, the cost of repairs, and the value of the property.

The adjuster will prepare a report and recommend an amount to be paid for repairs. This is called a settlement offer.

Many Times, People Aren’t Compensated Properly

It’s important to remember that your insurance company’s adjuster is not on your side. Instead, they are there to ensure the company saves money by offering you less than you deserve.

That’s it!

Your adjuster will not advise you against settling for less than what you’re entitled to under the policy; instead, they’ll leave that up to you and hope that the offer is tempting enough for you not to fight back. If this sounds like a problem, that’s where Link Public Adjusting Group comes into play!

If You Don’t Have Experience, Hire a Professional

Knowing your rights and how to protect yourself in a situation like this is essential. The best way to do that is by hiring an independent claims adjuster, who will help you understand your rights and the process and provide valuable insight into the value of your claim.

If you don’t have experience dealing with insurance companies, hire a professional.

As soon as possible after the loss, contact an independent adjuster to represent your interest in dealing with the insurance company. An independent adjuster can help you obtain a fair settlement and maximize your claim’s value.

Hiring a claims adjuster for storm damage is an excellent way to protect your property. Storms can cause extensive damage, and it’s essential to have someone help you recover from the storm and get your home back on track.

A claims adjuster will work with you to ensure that your insurance coverage requirements are met after a disaster has occurred. The Link Public Adjusting Group team offers expert insurance claim consulting and adjustment services to communities across Florida. Call us today at (866) 522-1049!